All goods imported into Canada are required to be classified in accordance with the Harmonized System (HS).

The Harmonized Description and Coding System (Harmonized System or HS) is an internationally recognized nomenclature for the classification of goods developed and maintained by the World Customs Organization (WCO). The HS is used by more than 200 countries as a basis for their customs tariffs and for the collection of international trade statistics.

The Harmonized System in Canada explained

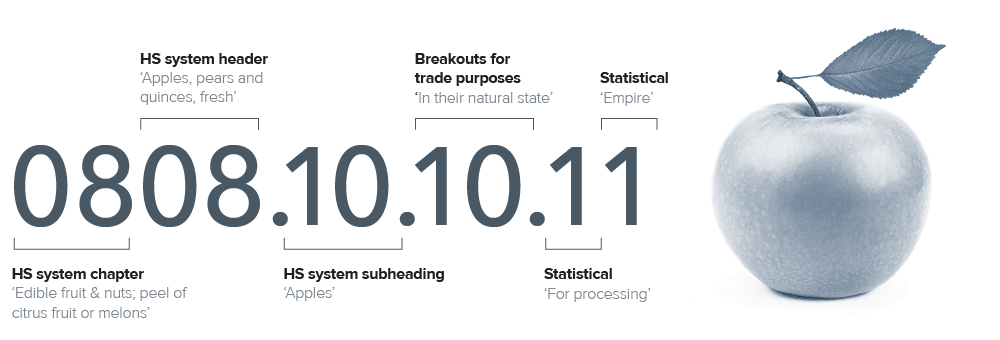

It works like this: ten digit HS Codes are assigned to imported goods. The first six digits denote the international portion of the classification number and are used by all countries on the Harmonized System; the last four reflect Canadian tariff and statistical requirements.

Accurate tariff classification has become increasingly important with the advent of HS Code requirements for goods imported into Canada.

The HS classification number not only determines the duty rate that may be applicable to imported goods, but is used by many participating government agencies to help determine additional data or documentation requirements, establish eligibility for preferential duty rates under certain trade agreements, additional duties, taxes, or levies imposed, and to track quota fulfillment and limitations on imported goods.

Take charge of your bottom line by determining the costs of imported goods prior to import. Put yourself in the driver's seat to know first-hand what's needed and what it will cost.

If you prefer, you can find out for yourself, in advance, by looking up HS codes online by using one of the many tools available to importers.Please be aware that although classification tools may provide general guidance in the classification of goods, if you are unsure of the classification number, or applicable duties, we highly recommend that you obtain an Advance ruling for tariff classification. Livingston Consulting can assist with obtaining various rulings.

For additional information regarding classification please attend our On Demand webinars.

Still need help? Livingston offers tariff classifcation services—contact your service coordinator for more information.